Do people trust you?

“OF COURSE THEY DO!” I hear you shout indignantly! Because trust sits at the heart of a financial adviser’s business. It’s that critical ingredient that you can’t survive without, but unfortunately you can’t just go out and buy it, or even simply ask for it. It can only be earned by what you do, and by what other people say about you.

Trust in business is low…

Every year, I review the very insightful Edelman Trust Barometer, an annual, highly credible review of trust that has been carried out for 20 years now and across 28 different countries. They announce the results each year at the World Economic Forum in Davos. The full results for Ireland in 2020 are available here and are well worth a look. Edelman look at trust in each of the countries (one being Ireland) and examine trust across different sectors and industries.

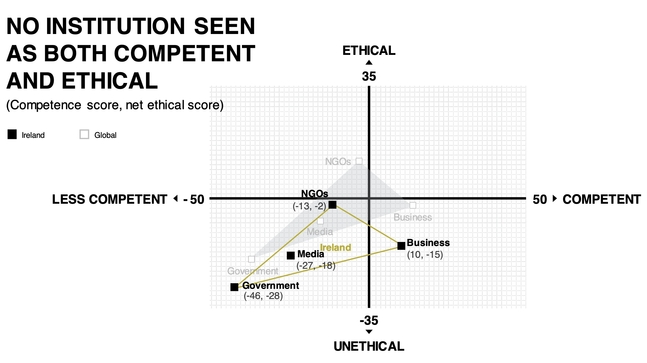

In the chart below, we can see that trust in business in Ireland is low. While seen as somewhat competent, businesses score poorly in terms of ethical behaviour and we lag our international counterparts in this regard.

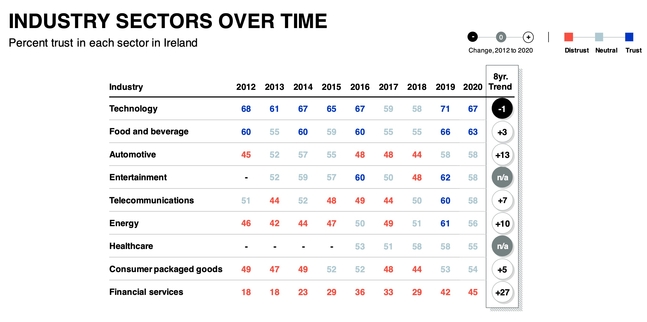

What’s the situation in relation to Financial Services?

As can be seen from the graph below, Financial Services is the least trusted industry sector of all. A fact we simply cannot ignore.

This is a critically important finding for all financial advisers to consider. While the poor level of trust applies to the sector as a whole and not specifically financial advisers, it underlines the challenge faced by all industry participants in building trust with potential clients. People you meet for the first time will often be starting out with a sense of distrust and scepticism. This cannot be ignored by you and your first task is to start building trust…

However every cloud has a silver lining. While financial services is the least trusted sector and is coming from an extremely low base after the economic crash, the sector is moving towards the other sectors. A lot done, a lot more to do…

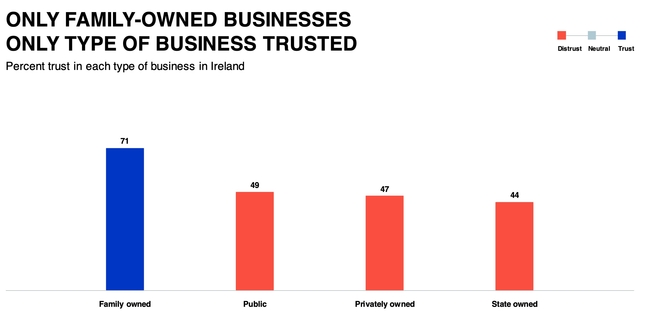

Another chart that is of interest is the level of trust across different business types. This is great news for many financial advice firms out there!

“But my clients do trust me” I hear you say!

And I’ve no doubt that your clients do trust you… or else they wouldn’t stay with you. However the challenge is about appealing to all those people out there who are sceptical of the financial services industry, and potentially of financial advisers. How do you appeal to them?

It all starts with having a clear and compelling client value proposition, which is a clear, concise and compelling articulation of how the factors that are important to the customer are satisfied by you.

The What, How and Why of your business

To start to build a positive picture, leading to confidence in your ability in the eyes of prospective clients and ultimately to building trust, it’s worth considering the lessons of Simon Sinek, the famous author of “Start with Why”. Yes you need to be able to clearly define initially what it is that you do, so that clients can see the outcomes that they can expect. You then need to be able to communicate this effectively to clients. However it is difficult as a financial adviser to stand apart from the crowd in terms of what you do, as many of you deliver similar services.

However when you can set out in an engaging way how you work with clients, now you’re starting to get somewhere! When you are able to demonstrate the processes that you use, how you deliver advice, how you will serve your clients throughout their financial lifetimes; you are now in a strong position to start building durable trusted relationships. Potential clients will take a lot of comfort from understanding what they can expect from you, and this comfort in working with you will enhance their trust.

The real magic though in building trust is when you can clearly (and of course credibly!) communicate why you do what you do. This will demonstrate your real reasons for being a financial adviser, your passion for what you do and ultimately your desires to deliver a really top quality proposition to your clients. And when you can communicate this effectively, this will build trust like nothing else.

In a future article, we will look in more detail at some of the actions you can take to help you build a trusted position in the eyes of all of your current and potential clients.