How will you grow your business?

What’s the question I’m most frequently asked by both prospective and existing clients? It is “How can you help us grow our business”. Of course, there’s no one simple solution or silver bullet for this one, instead there are a number of different strategies and tactics available to you…

Before we help advice firms decide and implement the right approach for them, we carry out a very detailed analysis of your business. It’s very important that you choose your preferred strategy with your eyes wide open as to its suitability for your business in terms of a number of factors such as,

- The new client opportunities open to you

- Your appetite and desire to network, both online and offline

- Your appetite to potentially develop new qualifications, services and new areas of expertise

- Your appetite and expertise to undertake different marketing activities

- The budget and resources available to you

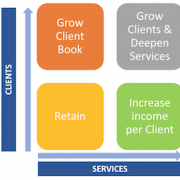

You need to start by understanding where your strengths are and how you can best utilise them. While of course the grey quadrant looks the most attractive, it is not going to be the right strategy for many firms! So, it is worth taking a look at each of the quadrants in turn.

Retain

This is of course the most passive of all of the strategies, and it could be argued that it is not really a growth strategy. Maybe it’s a “prevention of loss” strategy? But it is a very important minimum approach for every firm. This entails meeting the needs of your existing clients on an ongoing basis, providing them with the advice, support and service that you promised to them at the outset of your relationship with them. This includes providing the level of service that they can reasonably expect from you, and that allows you to fully justify the income you earned already from them, and the ongoing income that you continue to earn.

While this may appear too passive to some, this is a strategy that may make sense for advisers coming towards the end of their career. Your business may have delivered the lifestyle that you wanted over the years, with the final task being to retain your book of clients with a view to selling it in the not too distant future.

Grow your client book

This is the more traditional approach, coming from an era when an adviser’s income was generated largely by initial commission. While of course new clients are still very important to every business, they are not the single driver of success that they used to be. If we look back 20 or 30 years in the financial advice sector, ongoing service to clients played a much lesser role and resulted in very low levels of ongoing income. As a result, businesses survived by a constant stream of new clients. And this in turn resulted in advice firms having lots of “transaction based” client relationships, as opposed to the deeper client relationships that we see today.

Of course there are many firms continuing to pursue a client acquisition strategy today, constantly seeking to bring new clients on-board and looking to grow their overall client numbers. For the networkers / rainmakers among you, this may be the strategy for you. It’s hard, because you need to be constantly “out there”. But if your skill set is in this area (and not necessarily in the areas as set out below) and you have the right supports around you, this may be your preferred approach.

One of the downsides of this approach is with less of a focus on ongoing services, you cannot command the same levels of ongoing remuneration and as a result this will dampen future valuations of your business. This also requires a higher marketing spend, as you attend events, entertain prospects, advertise and carry out sponsorships to raise awareness of your brand and undertake other client acquisition strategies.

Increase Income per Client

This is the area today where I spend most of my time with my adviser clients. Under our “Getting to 1%” programme, we pose the valid question – Why and how do advisers in other developed markets (and some advisers in Ireland) charge an ongoing fee / trail commission of 1% of assets, while in Ireland it’s typically 0.25% to 0.5% p.a.?

The answer lies in having a client proposition that justifies higher income levels and then being able to communicate that effectively. This takes significant effort, thought and work. It may take higher levels of qualifications, new skills and broadening out the services that you provide. We see this in financial advice firms today evolving into financial planning firms. These firms are developing much deeper relationships with clients through providing lifestyle financial planning, with future cashflow planning being a core element of this. This takes investment in your business, time and effort to develop the required technical skills and capabilities. And then you have to be able to communicate it all effectively across all platforms. Some advisers who are in this quadrant are actually seeking to reduce the number of clients overall. This is typically where they are trying to shed transactional clients who are not open to deeper relationships.

The payback for advisers who successfully carry out this strategy is immense. The same (or lower) number of clients, but now generating multiples of the level of income that you were previously getting.

Grow Clients and Deepen Services

Is this nirvana? From my experience this happens as a result of successfully occupying the green quadrant – increasing income per client. Where advisers offer an excellent client proposition and are communicating it very effectively, referrals just happen because your clients love what you do and talk about it. So some of these firms in the green quadrant end up in the grey, because new “perfect” clients from your target markets come looking for your services. Isn’t this the best place to be?