Different people want (and deserve) different things

How many clients have you? 200, 500 or 2,000? Often as your client base grows, it results in your number of staff growing. But the chances are that even with your increased staff numbers, you are unable (and unwilling) to provide a top-drawer service to every one of these clients…

Really the question is – why should you? After all, you derive hugely varying levels of income from each of those clients so surely the clients that are driving very high levels of income to your business deserve a higher level of service?

Of course this is not at all a novel concept! Every time you step on a long haul flight, it’s immediately obvious. Turn right for the cheap seats in Economy or turn left to be pampered in Business Class or 1st Class. And then when you book a hotel, you can pay less for a standard room or pay more for a suite with all of the bells and whistles that come with that.

Now let’s take this concept into the financial advice space where for many of you, your remuneration model is built around trail commission. If I’m fortunate enough as an investor to come to you with €1 million to invest, your trail commission might be €5,000 p.a. (assuming you charge 0.5% of assets). That’s fine if your proposition stacks up.

But what happens if I decide to place just €200,000 of my money with you? Now your trail commission falls to €1,000 p.a. Still very attractive, but obviously not as nice. However the question that’s in my head is, “What extra am I getting from you by placing the full amount with you, that’s giving you the benefit of an additional €4,000 p.a. of my money?”

If there is no difference between the services offered in each of these situations, I suggest you’ve got a challenge on your hands… Simply adding trail commission to policies without thinking through your client proposition is fraught with danger.

Not completing a robust segmentation of your clients is also very dangerous. Even without doing a segmentation exercise, I’ve no doubt that a small number of your high value clients get your best service at all times. But inevitably what happens is that there are other high value clients that slip off your radar. Either you don’t realise that they are high value or they just aren’t demanding. This is aside from some low value clients who are constantly on the phone end up getting a huge amount of attention. That’s hardly fair, is it?

So what do you do?

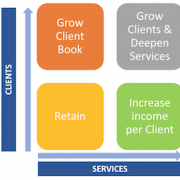

Segment your clients

For starters, do a proper segmentation exercise. Know who is valuable to your business and who is not. Don’t be put off from doing this work with the excuse of “it doesn’t capture the full picture”. Yes, there will always be exceptions within your segmentation – for example a client with very little business with you, but who constantly refers other clients to you is actually a high value client to you and should be treated as such. But don’t start with the exceptions; work out how to deal with them later on a case-by-case basis.

I’m definitely not suggesting that client segmentation be based on asset values alone – that is only one factor to be considered and used. However it is usually one of the more heavily weighted factors used by advisers in segmenting their clients.

Develop your service packages

Develop service packages for your business that reward clients depending on their value to your business. Make your high value clients feel really special, reward them for trusting you with their money by giving them a truly rewarding client experience. Build a moat around them and pull up the drawbridge from your competitors by providing a second to none service.

Let your mid-tier clients feel valued by your business, while making them aware that there is lots more you can do for them (if they are willing to pay for it).

And of course your no/low value clients will begin to realise that it’s a business you are running and that they don’t have 24/7 access to you. If they want access to superior service (ongoing advice from you), they pay more for it. The same as when they book a flight or a hotel room.

Don’t be afraid to say no

Yes, your lower value clients may want a better service possibly than you are offering and might try to demand it from you, without paying for it. Don’t be afraid to say no. You’ll only be doing this with your no/low value clients… And they are of little or no value to your business. Put your time into those clients that are of value to you – this is what your clients deserve and what your capacity allows.

The days of a “one size fits all” approach are over. Give your clients a service that they want and deserve.